Payment Processor - Truths

Table of ContentsNot known Facts About Payment ProcessorWhat Does Payment Checkup Mean?Not known Details About Payment Solution Rumored Buzz on Online Payment SystemsThe 5-Minute Rule for Payment SolutionThe Greatest Guide To Online Payment SystemsThe Only Guide for Ecommerce7 Easy Facts About Ecommerce ShownSome Known Facts About Payment Solution.

The B2B settlements space is pretty crowded. Numerous financial institutions, fintech firms, and sector specialists supply B2B payments platforms, and new firms are entering the space regularly. We looked into the options, as well as here are some of the most effective B2B payment services: Finest for: B2B organizations who buy or sell on net terms.9% handling charge (similar to what Pay, Buddy and Square charge for credit card repayments). There's additionally checkout performance with Fundbox Pay.

Payment Processor Can Be Fun For Anyone

Fundbox Pay's B2B remedies basically shift the danger of the customer not paying away from the seller. This is comparable to using bank card in the consumer room. When somebody mosts likely to a dining establishment or acquires a film ticket with a credit scores card, the vendor makes money right away, and the consumer delays repayment for a billing cycle.

Not known Details About Payment Processing

Pay, Buddy is a heavyweight in the B2B settlements industry. All they have to do is click the "pay" switch, and they can pay with their Pay, Buddy equilibrium, a connected bank account, or a credit rating or debit card.

30 per settlement. Charges are a little higher for phone settlements or for using a kept debt card. card processing.

The 8-Second Trick For Payment Processing

Quick, Books is just one of the greatest names in tiny service, best understood for their accountancy software program. Quick, Publications additionally gives a B2B repayment service that works likewise to Square as well as Pay, Chum. You can email invoices to customers, with instant alerts when the consumer sights and pays the invoice.

Best for: B2B purchasers that intend to centralize settlements with a charge card. A distinct participant in the B2B repayments room is Plastiq. have a peek at these guys One reason that handling B2B settlements is challenging is that various suppliers favor different settlement approaches. One supplier could request ACH transfer, while an additional asks for cable transfer.

An Unbiased View of Payment Solution

Best for: B2B vendors that offer on the internet checkout to wholesale customers. Profession, Gecko is a stock as well as order administration company, but additionally offers robust B2B settlements remedies. There's an e-invoicing item similar to Square and Pay, Chum. Nevertheless, they likewise offer a payment portal for wholesale buyers. Essentially, this is comparable to an on-line check out experience for business customers.

On top of Trade, Gecko's monthly charge, when your consumers pay with a credit scores card, you'll pay a 2. There are lots of B2B payment options to select from, whether you're on the paying end or obtaining end.

Top Guidelines Of Payment Solution

Whichever B2B settlement solution you select, many small company proprietors locate themselves on the paying end and also getting end. Below are some best methods when you're the buyer: Clear your accounts payable balance by paying right after the transaction. Use a credit history card to pay if you need more time to integrate the price.

Use your positive settlement history to negotiate positive terms with new distributors. Here are some finest methods when you're the seller: Send out a billing or repayment demand right after the transaction.

How Online Payment Systems can Save You Time, Stress, and Money.

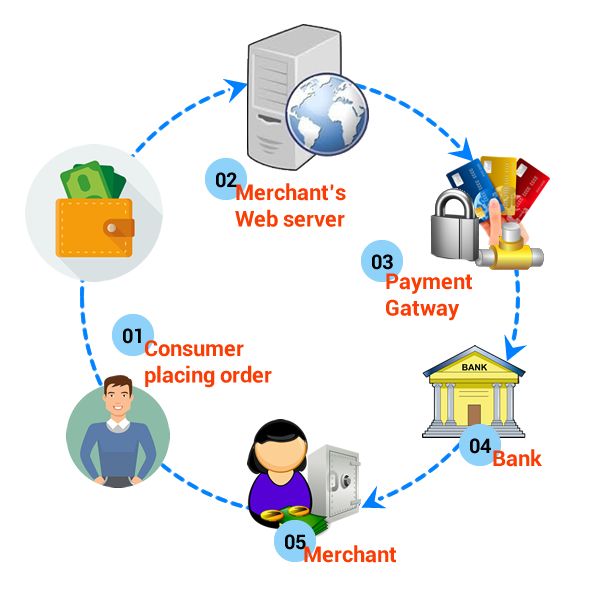

What are the Elements of a Settlement Stack? Over the last decade, settlement innovation has progressed beyond simply permitting vendors to refine bank card. The robust collection of modern technologies and also abilities that integrate to create modern-day fintech services are frequently described as "the repayment stack."The term "payment pile' is used to describe all the modern technologies as well as components that a business uses to approve settlements from clients.

The Buzz on Merchant Account

These are several of the elements of a repayment pile that collaborate to produce a frictionless commerce experience for companies, financial institutions and also clients. Scams Prevention, As modern technology remains to proceed, illegal activity proceeds to advance. It ought to More Bonuses come as not a surprise that merchants and also various other businesses are experiencing more information violations than ever.

It's ideal to maintain a record of every purchase within the firm by utilizing accounting software program, however additionally beyond the company. This is done by additional resources checking documents with the banks that tape the purchases. If a mistake is made, merely align your company's records with financial institution declarations to find the resource of a mistake.

Not known Facts About Ecommerce

Check out User interface, A good check out user interface makes it very easy for consumers to see pricing in their local currencies as well as to find as well as use their favored regional repayment techniques. The checkout interface is a critical part of your site experience and also essential for making certain you do not shed customers that wish to purchase from you.